Our history

NN has a strong history that stretches back 175 years. Over the years we have built leading positions in our chosen, predominantly European markets. Our roots lie in the Netherlands of the 18th century, when regional funds were founded.

Discover our history

-

Introduction

Our roots

NN’s roots lie in 18th-century the Netherlands, when regional funds were started to insure people of certain communities and professional groups, as well as widows and orphans. Later, more common insurance companies arose. These included the fire insurance company the Haagsche van 1805, the Hollandsche Sociëteit van Levensverzekeringen (the first company that based policies on actuarial calculated risks in 1807), and RVS, founded as a funeral fund in 1838.

Over the years, Nationale-Nederlanden acquired many of these funds and companies, or their successors.

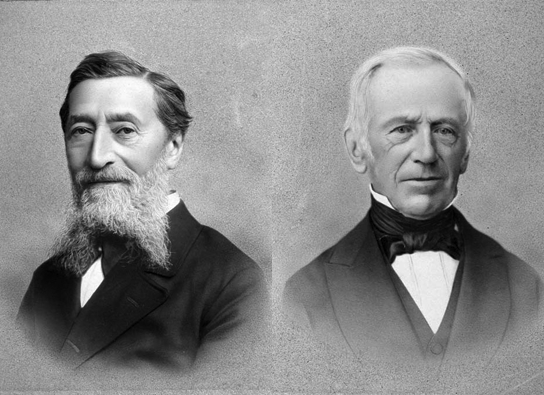

Our founding fathers

Two pillars formed the company we are today. The first was De Nederlanden van 1845, a fire insurance company in Zutphen. The second was Nationale Levensverzekering-Bank, a life insurance company founded in Rotterdam in 1863. In 1963, these two prominent companies merged into Nationale-Nederlanden, which became the market-leading company in the Netherlands. Combining Nationale’s strong domestic position and De Nederlanden’s international experience was a strategic decision, designed to prepare the company for the future.

Our international expansion

Nationale-Nederlanden’s financial power allowed it to expand foreign operations. The United States was one of the largest areas of expansion. For example, in 1979, the Life Insurance Company of Georgia was acquired. Through this company, Nationale-Nederlanden also expanded its presence into Asia in the 1980s.

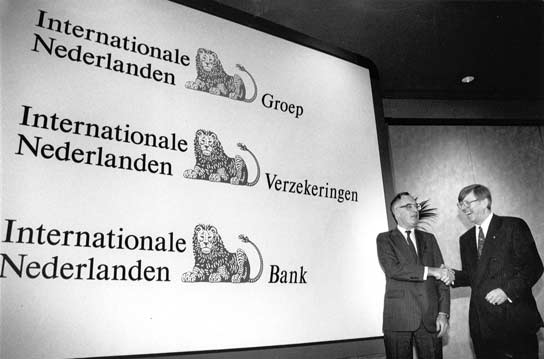

In 1991, Nationale-Nederlanden merged with NMB Postbank Groep, and formed a new, integrated financial services company: Internationale Nederlanden Group (ING). The company offered customers a broad range of insurance, banking and asset management products, and had a wide variety of distribution channels. ING had a strong position in the retail and corporate sectors. A new legal sub entity – ING Insurance – absorbed all of Nationale-Nederlanden’s activities.

Becoming NN Group

In 2008, the financial crisis started and ING took a capital injection from the Dutch Government. As a condition the European Union demanded a number of changes to ING’s company structure. This resulted amongst others in an operational split from between ING Bank, and ING Insurance and Investment Management in 2012.

ING Insurance and Investment Management accelerated preparations for a stand-alone future with European and Japanese insurance and investment management operations. (ING Group had already divested its insurance activities in the Americas, Australia, and in most Asian countries by this time.)

On 2 July 2014, NN Group became a listed company with shares on Euronext Amsterdam, under the listing name ‘NN Group’.

Today

NN Group is an international financial services company, active in 11 countries, with a strong presence in a number of European countries and Japan. With our 16,000 employees, NN provides retirement services, pensions, insurance, banking and investments to approximately 19 million customers. NN Group includes Nationale-Nederlanden, NN, ABN AMRO Insurance, Movir, AZL, BeFrank, OHRA and Woonnu.

-

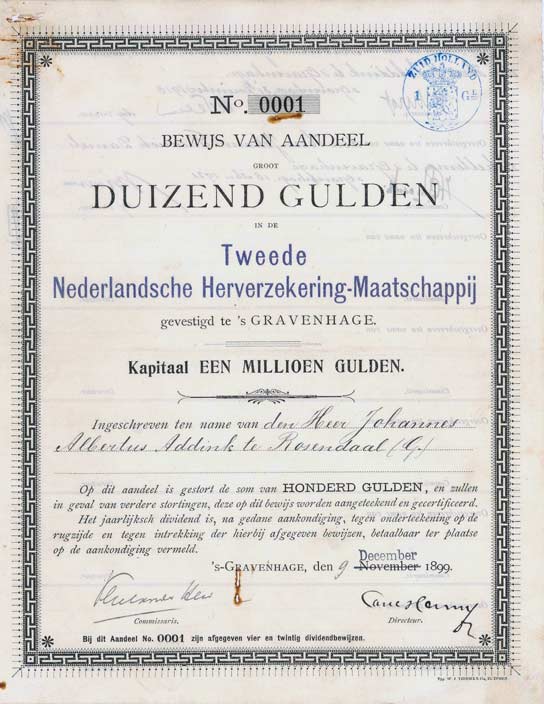

1845 / Assurantie Maatschappij tegen Brandschade

In Zutphen, a small town in the east of the Netherlands, two cousins establish a fire insurance company. The company does not merely insure against fire and other risks, but also seeks to prevent risks by installing a voluntary fire brigade manned by all staff members of De Nederlanden. Several years later, the name changes to De Nederlanden van 1845 and the company moves to The Hague. It merges with the Nationale Levensverzekering-Bank in 1963 to form Nationale-Nederlanden.

1857 / Expansion abroad

Soon after its incorporation, focus shifts to expanding the scope of its operations in the Netherlands and abroad. De Nederlanden van 1845 expands first to the Dutch East Indies, then to other European countries and finally to the rest of the world. The first foreign agency is set up in Batavia in 1857. By 1900 there are over 400 representatives and agents.

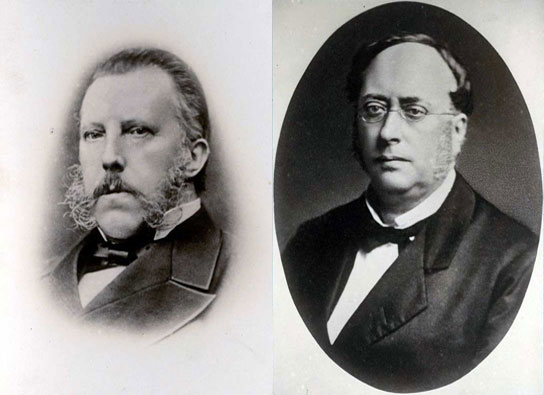

1863 / Nationale Levensverzekering-Bank

Founded in Rotterdam in 1863, the Nationale Levensverzekering-Bank is one of the few Dutch life insurance companies at the time. The market was dominated by foreign life due to a provision in the law, which the Nationale helped abolish in 1880. Several takeovers consolidate the organisation, which merges with De Nederlanden van 1845 into Nationale-Nederlanden in 1963.

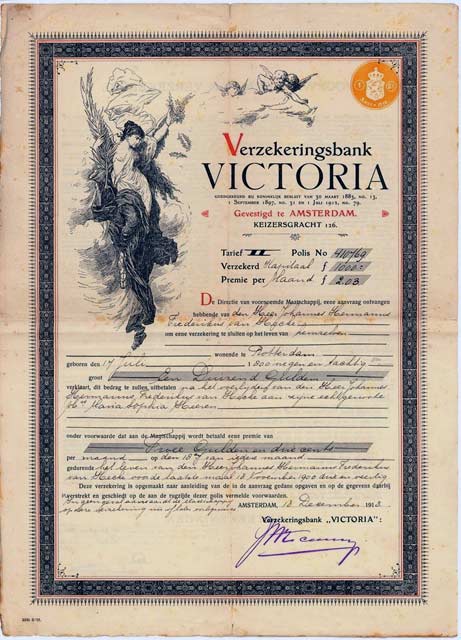

1883 / Verzekeringsbank Victoria

Victoria started out in 1883 as a sickness fund in Amsterdam, and soon expanded into life insurance. From 1925 the focus was purely on non-life. Victoria is taken over by De Nederlanden van 1845 in 1938 and merges with Vesta in 1971, becoming Victoria-Vesta.

1893 / Vesta

Founded in Amsterdam as a social life insurance company before moving to Arnhem. In 1931, the Nationale Levensverzekering-Bank acquires the company for its social insurance portfolio. In 1971, Vesta merges with Victoria to become Victoria-Vesta.

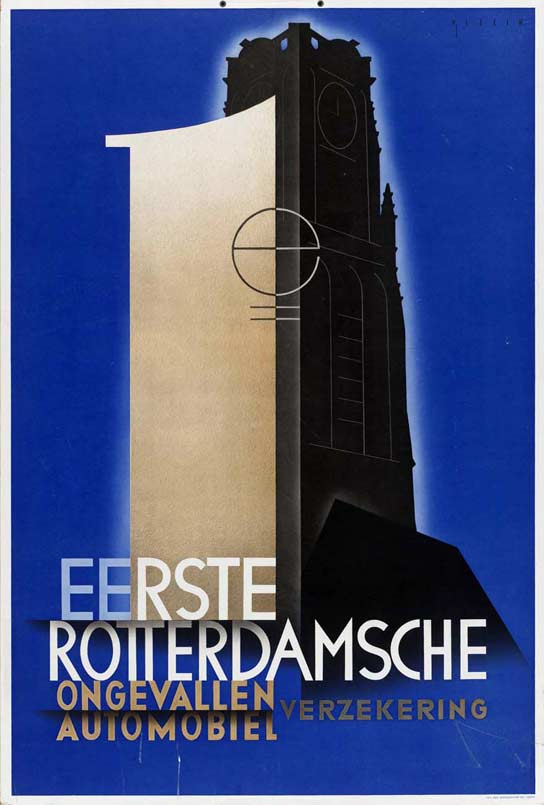

1896 / Eerste Rotterdamsche

In 1896, Eerste Rotterdamsche opens its doors with life, accident and disability insurances. From 1916, the company focuses solely on accident insurance. In 1928, the company is taken over by the Nationale Levensverzekering-Bank and continues operating under its own name until 1970.

-

1913 / Belgium

Start of life insurance business in Belgium through RVS, with offices in Antwerp and Brussels. Predecessors of NN operating in Belgium include L’Avenir (1895) and the Vaderlandsche (Patriotique, founded in 1906. Another was La Laborieuse Societe Anonyme, founded in 1927.

1932 / Bureau voor de Groepsverzekering

Cooperation between De Nederlanden van 1845 and the Nationale-Levensverzekering-Bank in order to offer collective pensions to companies and associations. ("Now Corporate Clients")

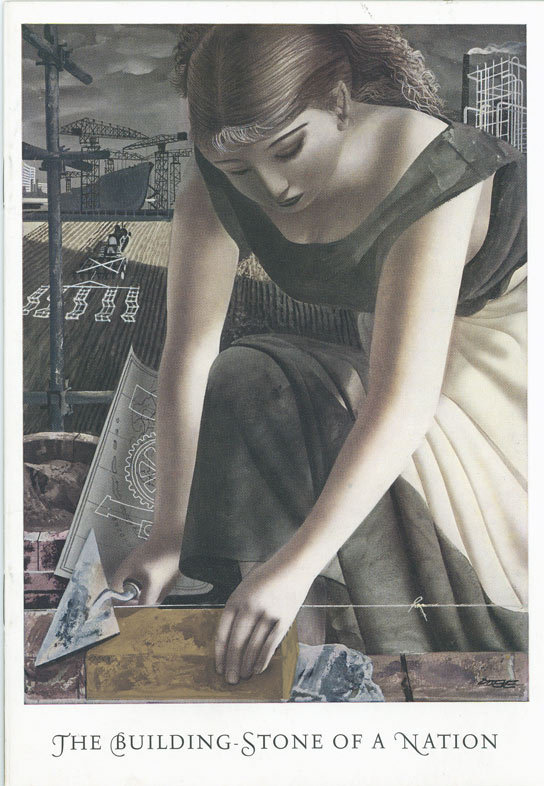

1950 / Rebuilding

The Netherlands starts to rebuild after the Second World War, the so-called ‘wederopbouw.’ There is much work to be done, particularly in cities destroyed by the war. Predecessors of NN help to finance the building of flats, factories, schools, shopping centres and housing estates.

-

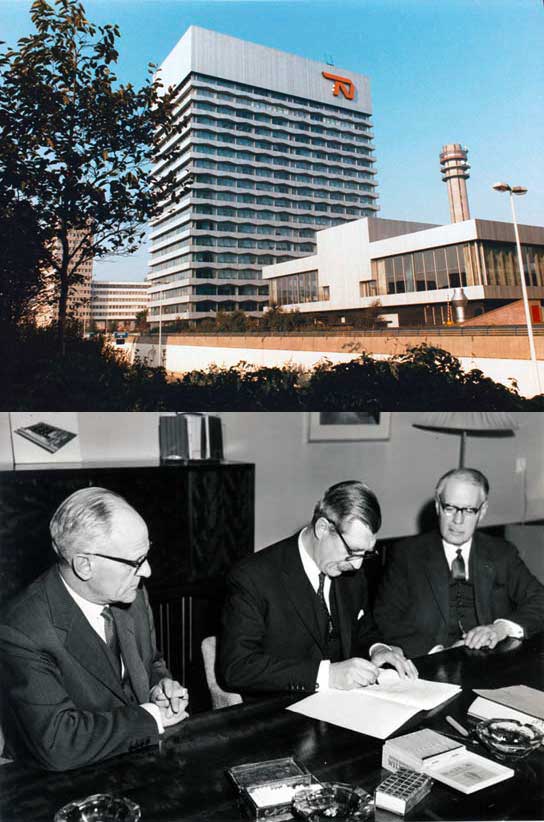

1963 / Nationale-Nederlanden

Merger between the two biggest Dutch insurers; De Nederlanden van 1845 and the Nationale Levensverzekering-Bank. The financial strength of this merger is put to use in expanding foreign operations. The United States is one of the largest areas of expansion. In 1979, the Life Insurance Company of Georgia is acquired. Through this company, Nationale-Nederlanden expands into Asia in the 80s.

1960-1980 / More expansion

After Second World War our foreign expansion strategy changed. Rather than working with local agents, the company increasingly starts to acquire foreign companies and open its own offices abroad. The first offices are opened in Canada, the US and Australia, where the company insures Dutch emigrants in their new homelands. Companies acquired in the US include Peerless (1957), Security Life of Denver (1977) and Life Insurance Company of Georgia (1979).

1969 / Westland Utrecht Hypotheekbank

(WUH) The merger between the Westlandsche and the Utrechtsche Hypotheekbank into WUH heralds the end of a wave of mergers and acquisitions that commenced before the Second World War. At that time, there were over 70 mortgage lenders in the Netherlands and in 1969 almost all are grouped in WUH. The crisis in the 80s hits WUH hard and it is acquired by Nationale-Nederlanden in 1982.

1971 / Victoria-Vesta

Merger between Victoria and Vesta. The companies moved to Ede in the Netherlands and subsequently merge with RVS in 1993.

1978 / Spain

In 1978, Nationale-Nederlanden decides to build up a greenfield business in Spain, starting in Madrid and rolling out to other Spanish cities. Always under the Nationale-Nederlanden name. (Life and non-life)

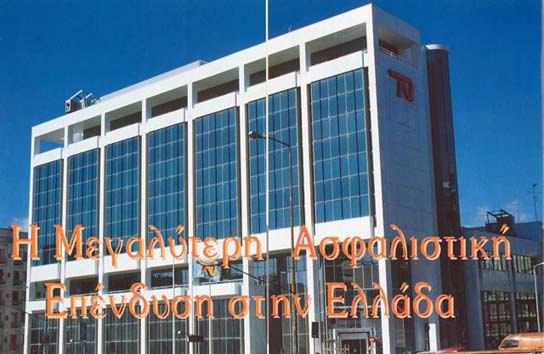

1982 / Greece

With the takeover of Proodos Hellenic Insurance and Reinsurance in Athens, Nationale-Nederlanden acquires a foothold in Greece. Two years later, Nationale-Nederlanden opens its own office and starts to build up a new network with agents.

1986 / Japan

Activities commence in Japan. In 1982, Nationale-Nederlanden opens a ‘representative office’ in Shell’s office building. The petrol stations of Showa/Shell initially serve as a point of sale for indemnity insurances. In 1986, Nationale-Nederlanden acquires the necessary permits to become the first European insurer admitted to the Japanese market.

-

1991 / ING Group

Nationale-Nederlanden and NMB Postbank Group merged to form ING Group. The new company holds strong positions in both the retail and corporate markets through a wide variety of distribution channels and backed by a strong balance sheet. ING strengthens its European banking activities and focuses on acquisitions in the insurance industry. After the acquisition of Barings in 1995, ING becomes increasingly well-known as a brand. The combination of banking, insurance and capital management is the result of close collaboration between the many companies making up ING.

1991 / Hungary Nationale-Nederlanden

Magyarorsági Biztosító Rt launched its Hungarian life insurance business from a hotel in Budapest in 1991. In 1994, Nationale-Nederlanden moved to a historic building in Andrassy Street, where it was joined by ING Bank Hungary. In 1995, the company was renamed ING Magyarorsági Biztosító Rt and within three years had achieved market leadership in Hungary.

1992 / Czech Republic

Nationale-Nederlanden receives a license to operate a business in the Czech Republic – then still known as Czechoslovakia. Nationale-Nederlanden Životní Pojišťovna is the first to avail of a new law allowing foreign entrants into in the market. The company focuses on the life and pensions market with offices in Prague, Pilsen and Budweis. In 1996, the Nationale-Nederlanden building, known as Fred and Ginger, opens its doors.

1994 / Investment Management

Three years after the merger that created ING, the investment departments of the bank (Asset Management ING Bank) and the insurer (Securities and Loans Nationale-Nederlanden) merge into ING Investment Management. The asset manager handles loans and shares on behalf of the insurance company and investments for large institutional third-parties and funds.

1994 / Luxembourg

Via Belgium, the Vaderlandsche, ING Insurance got a foothold in Luxembourg.

1995 / Poland

Nationale-Nederlanden Polska officially commences selling life insurance in 1995, after receiving a licence from the Polish Finance Ministry in 1994. Initially distribution is handled through agents and offices in Warsaw and ING-owned Bank Slaski.

1996 / Slovakia

Nationale-Nederlanden receives a license to start up an insurance business in Slovakia. Nationale-Nederlanden Poistóvna A.S. sells individual life and pension insurances through a network of agents.

1997 / Romania

ING Insurance becomes the first foreign insurance company to sell life insurance in Romania under the Nederlanden Asigurặ᷃ri de Viat ặ᷃ Romani ặ᷃ S.A. brand. This greenfield operation grows rapidly to employ 280 agents, working from six cities across the country.

-

2000 / Americas

With the acquisition of ReliaStar and Aetna, ING becomes one of the biggest life insurance companies in the US.

2001 / Bulgaria

Launch of ING Life Bulgaria, a greenfield operation that operates through a network of agents in Bulgaria.

2002 / Opening head office

New ING head office in Amsterdam opens its doors. Designed by Meyer en Van Schooten.

2008 / Financial turmoil

The global financial crisis forces ING Group to apply to the Dutch state for financial aid. Partly as a result of this, the European Commission forces ING to split its banking and insurance businesses in 2009. ING Insurance starts preparing for a stand-alone future from 2012 onwards.

2009 / Turkey

ING acquires Turkey’s fifth largest pension fund in December. Oyak Emeklilik sells individual pensions through a network of independent agents and through ING Bank Turkey.

2010 / ING Insurance

ING Insurance is the third largest life insurance company in the world and a global leader in retirement services. As of 1 January, ING Insurance has its own Management Board.

2012 / NN Bank

NN Bank is founded to continue providing so-called banksparen activities –fiscally attractive pension savings. In 2013 it incorporated the activities of WestlandUtrecht Bank.

2013 / ING Insurance Europa and Japan

The ING Life activities in Japan become part of the new insurance company, ING Insurance. A new name for the company is announced in October: NN Life Japan.

2014 / NN Group

As of 1 March 2014, ING Insurance becomes NN Group.

2014 / NN Group listed on Euronext Amsterdam

NN Group opened for trading on 2 July 2014 on Euronext Amsterdam under the symbol ‘NN’ after its initial public offering (IPO). Lard Friese, CEO and Chairman of NN Group, joined by members of ING Group (ING) and NN Group management teams, celebrated the company’s listing day by visiting the Euronext Amsterdam trading floor and by hitting the ceremonial opening gong.

2017 / Delta Lloyd

In 2017, NN Group and Delta Lloyd have joined forces in the Netherlands and Belgium. On 1 June 2017, NN Group established a legal merger to effectively achieve full ownership of the Delta Lloyd group. From that date, Delta Lloyd N.V. was not a listed company anymore and ceased to exist. The combination of the activities of NN Group and Delta Lloyd will result in an organisation better placed to capture innovative opportunities and facilitate continuous improvement in our products, distribution, and customer service.

2017 / NN Life Luxembourg

On 31 October 2017, NN Group announced that it had completed the sale of NN Life Luxembourg to Bankers Insurance Holdings S.A., part of the family of independent insurance companies supported by Global Bankers Insurance Group. The sale was a result of the continuous strategic assessment of NN Group’s portfolio.

2021 / NN Investment Partners

In 2021, NN Group announced the sale of its asset manager, NN Investment Partners, to Goldman Sachs Group, Inc. The sale was finalised in April 2022.

2021 / MetLife in Poland and Greece

In 2021, NN Group announced the acquisition of MetLife’s business activities in Poland and Greece. The acquisition was completed in April 2022.